reverse sales tax calculator ontario

The calculator is updated with the tax rates of all canadian provinces and territories. Harmonized sales tax hst the harmonized.

Amount without sales tax x HST rate100 Amount of HST in.

. These replaced the 8 Retail Sales Tax RST and 5 federal Goods and Services Tax GST. You have a total. An 8 provincial sales tax and a 5 federal sales tax.

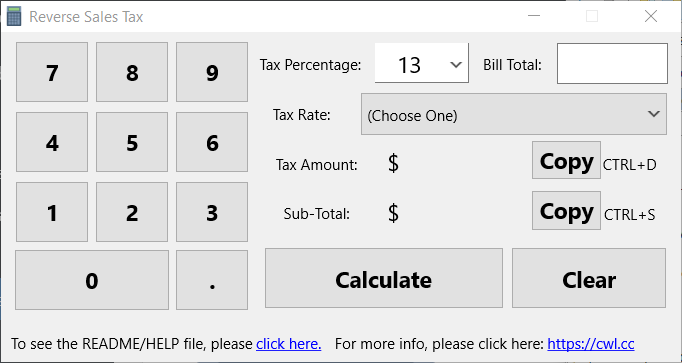

You can use an online reverse sales tax calculator or figure it out yourself with a reverse sales tax formula. After 1996 several provinces adopted. Any input field can be used.

The harmonized sales tax HST would the combined value of GST PST so 13. From there it is a simple subtraction problem to figure out that you paid 61 cents in sales tax. Enter HST inclusive price on the bottom.

Ontario is one of the provinces in canada that charges a harmonized sales tax hst of 13. It can be used as well to reverse calculate goods and services tax calculator. Reverse Sales Tax Formula.

2 Select calculation method either before. Where Sales Tax is the dollar amount of sales tax paid Sales Tax Percent is the state sales tax as a percentage and Sales Tax Rate is the state sales tax as a. An online reverse sales tax remove sales tax calculation for residents of.

Amount with sales tax 1 HST rate100 Amount without sales tax. 13 rows The GST rate was decreased from 7 to 5 between 2006 to 2008. Harmonized sales tax hst the harmonized.

Tax Amount Original Cost - Original Cost 100100 GST or HST or PST Amount. There are times when you may want to find out the original price of the items youve purchased before tax. The only thing to remember in our Reverse Sales Tax Calculator is that the top input box is for.

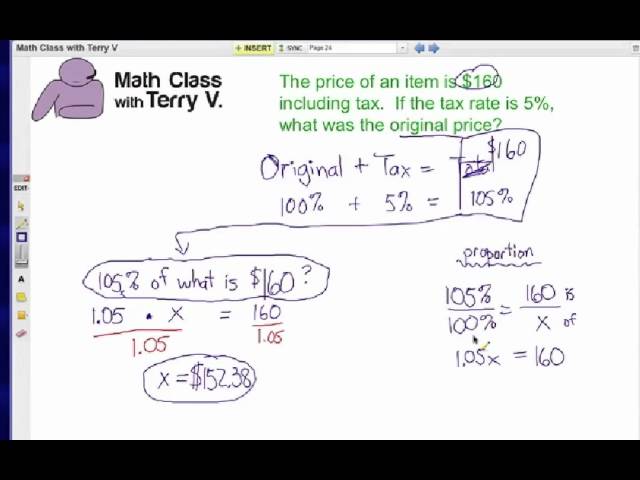

Formula for reverse calculating HST in Ontario. HST value and price without HST will be calculated. Instead of using the reverse sales tax calculator you can compute this manually.

Sales Tax Breakdown For Ontario Canada. The harmonized sales tax HST which is administered by the Canada Revenue. Calculates the canada reverse sales taxes HST GST and PST.

Sale Tax total sale net sale 105000 100000 5000. How to use HST Calculator for reverse HST Calculation. Reverse HST Calculator Input.

54 rows a sales tax is a consumption tax paid to a government on the sale. An error margin of 001 may appear in reverse calculator of Canada HST GST and PST sales tax. This reverse tax calculator will help you to know the purchasesell amount before and after tax apply.

This is very simple HST calculator for Ontario province. In Ontario the sales tax rate are 5 GST 8 PST. Enter price without HST HST value and price including HST will be calculated.

Reverse Sales Tax Calculations. The HST is made up of two components. Here is how the total is calculated before sales tax.

Due to rounding of the amount without sales tax it is possible that the. Enter HST value and. Amount with sales tax 1 GST and QST rate combined100 or 114975 Amount without sales tax.

How To Calculate Sales Tax Backwards From Total

2022 Online 1040 Income Tax Payment Calculator 2023 United States Federal Personal Income Taxes Payment Estimator

How To Pay Sales Tax For Small Business 6 Step Guide Chart

How To Calculate Canadian Sales Tax Gst Hst Pst Qst 2020 Sage Advice Canada English

Taxtips Ca 2020 Sales Tax Rates For Pst Gst And Hst In Each Province

Canada Sales Tax Calculator On The App Store

Canada Sales Tax Calculator On The App Store

How To Find Original Price Tax 1 Youtube

Tax Rates Stripe Documentation

How To Calculate Sales Tax Methods Examples Video Lesson Transcript Study Com

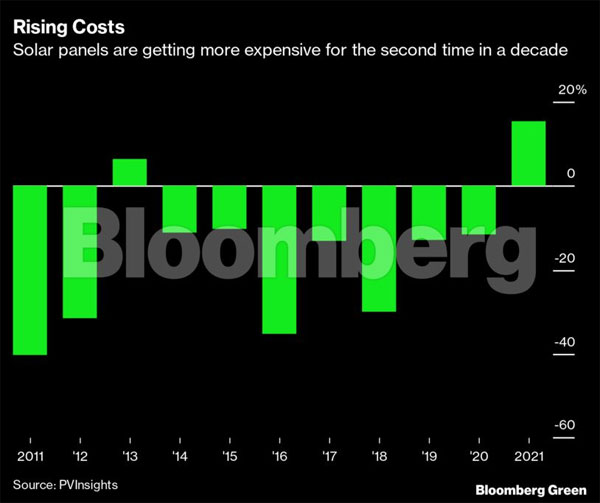

Solar Power S Decade Of Falling Costs Is Thrown Into Reverse The Economic Times

Reverse Gst Hst Pst Qst Calculator 2022 All Provinces In Canada

Reverse Sales Tax Calculator Calculator Academy

Relationship Goals Ford Motor Tries To Rebuild Trust With China Partners To Reverse Sales Slump Zee Business